Understand every move in

stablecoin markets

Identify risks early and uncover liquidity shifts with on-chain intelligence from Crystal Foresight

Current challenges with explorer tools

Fragmented data sources

Teams jump between explorers and datasets just to trace stablecoin movement across chains.

Unknown counterparties

Without clear wallet labels, issuers, holders, and liquidity partners stay hidden.

Missing context around flows

Explorers show transactions but not the market or supply forces driving them.

Inconsistent compliance visibility

Sanctions and blacklist checks vary across networks, leaving blind spots in risk coverage.

Manual and reactive analysis

Analysts waste hours compiling raw data instead of responding to real-time market change.

Introducing Crystal Foresight, a purpose-built stablecoin analytics platform that unifies cross-chain flows, entity-labeled counterparties, and market microstructure. Replace multiple vendors with decision-ready intelligence

Cross-chain intelligence

See the full picture across L1s, L2s, and bridges. Trace USDT, USDC, and DAI flows end-to-end to uncover opportunities before others do.

Verified entity insight

Identify who's moving capital. Track issuers, exchanges, custodians, and payment processors to reveal actual counterparties.

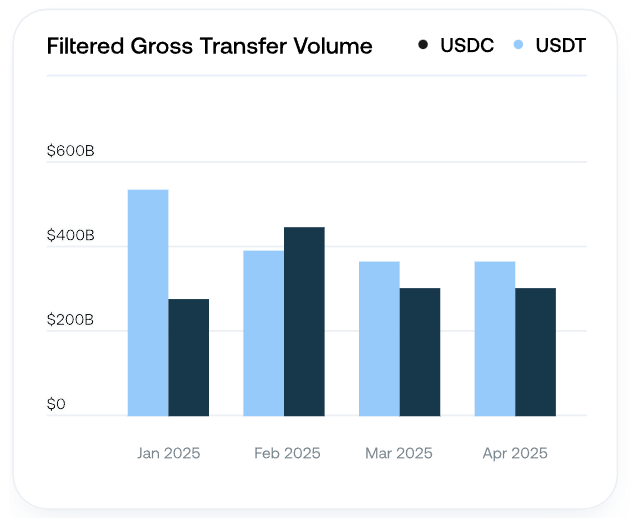

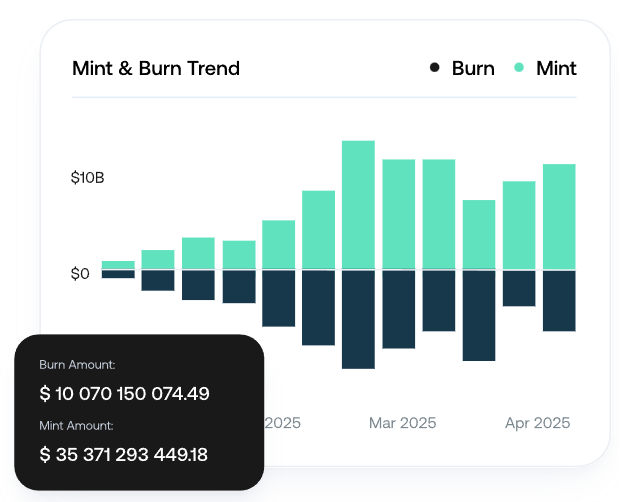

Supply & market dynamics

Stay ahead of every mint, burn, and peg shift. Connect issuance and redemption data to liquidity depth for early trend detection.

Liquidity structure analytics

Spot market stress and opportunity fast. View exchange depth, slippage, and cross-venue flows to anticipate liquidity shifts.

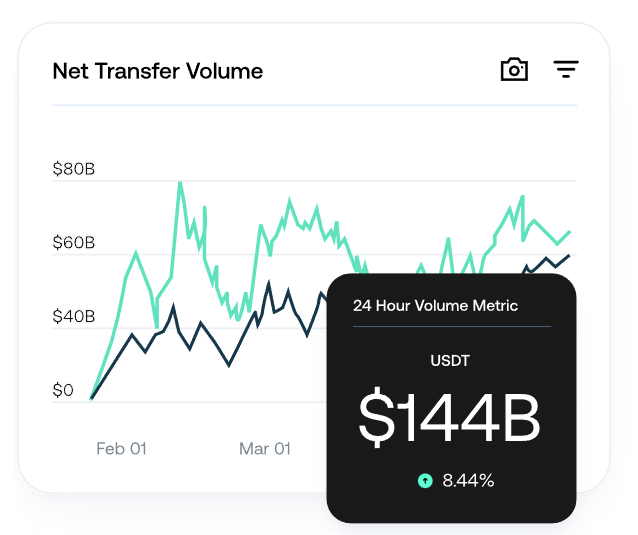

Intelligent flow analysis

Filter redundant transactions to surface real net movements. See directional balance changes between major entities instantly.

Crystal Expert integration

Drill down into transaction history, entity links, and funding origins directly from any dashboard metric and turn signals into action fast.

Tracking stablecoin liquidity cycles

Identify liquidity patterns

Track how stablecoins move between exchanges, wallets, and protocols to understand market dynamics.

- •Monitor cross-exchange flows

- •Detect arbitrage opportunities

- •Track protocol migrations

Predict market shifts

Use historical patterns and real-time data to anticipate liquidity movements before they impact prices.

- •Forecast supply changes

- •Identify accumulation patterns

- •Predict redemption waves

Optimize trading strategies

Make data-driven decisions about entry and exit points based on comprehensive liquidity intelligence.

- •Time market entries

- •Avoid liquidity traps

- •Maximize execution efficiency

Three ways teams use Foresight to drive strategy

Identify new opportunities

- •Entity-labeled net flows reveal business development opportunities.

- •Prioritize outreach based on actual market activity, not guesswork.

- •Identify which market makers and liquidity providers are active across multiple stablecoins.

Competitive positioning

- •Compare your liquidity sources vs. competitors.

- •Track relationship changes month-by-month.

- •Understand where competitors get growth and where you can differentiate.

Market movement prediction

- •Trace major mints/burns to specific entities and events.

- •See accumulation patterns before announcements.

- •Understand what drives supply changes in real-time with market microstructure context.

Built for competitive intelligence

Stablecoin issuers

Track competitor moves, discover partnership opportunities, and understand what drives market share, not just your metrics.

RWA issuers

Monitor liquidity for treasury decisions, benchmark your market position, and understand investor behavior patterns.

Exchanges

Manage risk with cross-chain flow intelligence, automate compliance, and access market microstructure insights for trading operations.

Why choose Crystal Foresight

Proven infrastructure

Built on Crystal's battle-tested blockchain analytics platform, trusted by leading financial institutions and regulators worldwide.

Real-time intelligence

Get insights as events happen, not hours or days later. Make decisions based on the most current market data available.

Actionable insights

Move beyond raw data to strategic intelligence. Every feature is designed to inform decisions and drive business outcomes.

Coverage

Monitor 15 stablecoins across 11 chains including Ethereum, Tron, Solana, BNB Chain, Polygon, Arbitrum, and Optimism.